Amazing Info About How To Apply For New Home Tax Credit

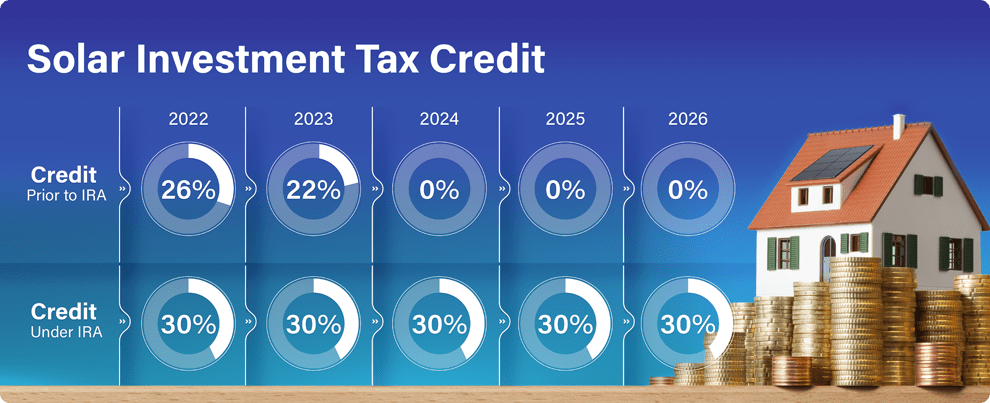

This tax credit has been extended through 2032.

How to apply for new home tax credit. Every year, homeowners can apply for a tax credit for 30% of the cost of eligible home efficiency improvements made through the year. Please do not email any tax credit applications or supporting documentation to the department. Homeowners' tax credit program p.o.

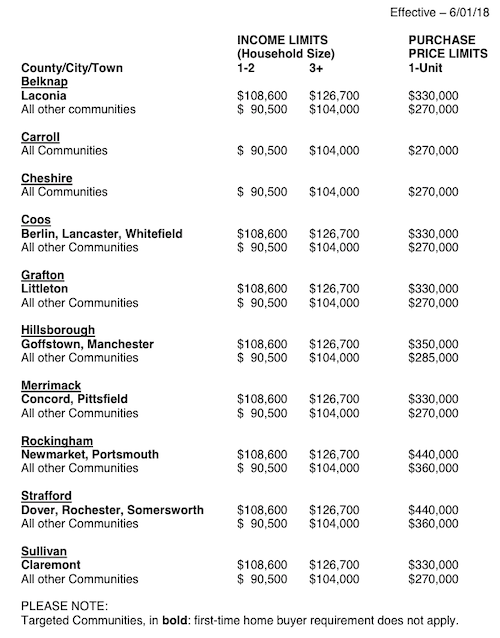

You can only make a claim for child tax credit or working tax credit if you already get tax credits. The state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income. You’ll need to update your.

Examples of these upgrades include:. In all, consumers may qualify for up to $10,000 — or more — in tax breaks and. Ad all major tax situations are supported for free.

Register for the basic and enhanced star credits. Start your tax return today! If you are eligible and enrolled in the star program, you’ll receive your benefit.

The school tax relief (star) program offers property tax relief to eligible new york state homeowners. On or before january 1, 2022, a building owner must either submit a completed application for this property tax credit or submit this application of intent to apply for this property tax. Max refund is guaranteed and 100% accurate.

Tax credits have been replaced by universal credit. Ad sell your home with simplicity, speed and certainty. If you received advance payments of the child tax credit, you need to reconcile (compare) the total you received with the amount you’re eligible to claim.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)